Blog Posts

Tax Tips for New Parents

Tax Tips for New Parents: How to Maximize Your Savings

Congratulations! Bringing a child into the world is a... read more

Tax Breaks and Home Sales

Tax Breaks and Home Sales - When you sell your home, there can be tax consequences that you should... read more

Tax and Corporate Sponsorship

Tax and Corporate Sponsorship

As business owners, we are usually involved with not-for-profits. And their mission is to raise money for... read more

7 Ways To Prepare For Tax Season

Tax season 2023 is almost upon us. According to the IRS, the 2023 eFile Tax Season starts in January 2023:... read more

Top 8 Mistakes On Tax Returns

Top 8 Mistakes On Tax Returns

A typo or unintentional error can become a significant problem when you file a... read more

Know Your Tax Responsibilities During Bankruptcy

You need to know your federal tax obligations during Chapter 13 Bankruptcy. Know Your Tax Responsibilities During Bankruptcy. Chapter 13 bankruptcy... read more

Is It Really The IRS?

How to know it’s really the IRS calling or knocking on your door

Many taxpayers have encountered individuals impersonating IRS... read more

This Isn’t a Tax Change

This isn't a tax change; it's a tax reporting change. If you're a gig worker, freelancer, or self-employed American, it might... read more

Tips to Reconstructing Records

Tips to Reconstructing Records. Do You Have Your Destroyed Records from the most recent disaster? The time and work recovering from... read more

Charitable Contributions and Taxes

Charitable Contributions and Taxes. If you give money or goods to a charity, you may be able to claim those... read more

6 Tips You Can Use To Lower Your Taxes in 2021

Here are 6 Tips You Can Use To Lower Your Taxes in 2021.

Leverage pre-tax savings. Take advantage of opportunities to...

read more

Tax Benefits for the Military

Tax Benefits for the Military - Members of the various military service branches may qualify for tax benefits not available... read more

Is it a Business or Hobby?

Jewelry making, baking cookies, teaching yoga, freelancer, and social media manager are a few home-based businesses that have become popular... read more

Have You Heard About “Ghost” Tax Preparers?

What is a Ghost” Tax Preparer?

Some taxpayers are a bit savvier than the average person and take great pains in... read more

How To Correctly Loan Money

Cousin Freddy needs a quick loan, and you graciously say, "How much?" and later, you wonder, what have I gotten... read more

Rent Your Property Tax-Free!

Rent Your Property Tax-Free!

Most income you receive is reported to the federal and state tax authorities as taxable income. However,... read more

Surprise! These Five Items Are Taxable.

Surprise! These five items are taxable. Of course, you already know that wages and self-employment earnings are taxable, but what... read more

A 2022 Tax Surprise!

A 2022 tax surprise… your tax liability may have increased. Check this out. For the past several years, your tax... read more

All Income Must Be Reported

Filing taxes? Then you must include all income in your tax preparation.

Here is a partial list of the types of...

read more

15 Year End Tax Tips

There are just 22 days left of 2021, and there is still some time left to consider these 15 Year-End... read more

7 Ways For Business Owners to Reduce Their Taxable Income

Taxes can be stressful for a business owner. You wear many hats, juggle many balls, and the last thing you... read more

Tax Moves to Make Before Year-End

Tax Moves to Make Before Year-End - Are you looking to try and reduce your taxable income? Here are some... read more

Why Do I need a Tax Strategy Session?

Why do I need a tax strategy session? A year-end tax planning meeting with your Enrolled Agent (EA) is a... read more

Employee Tax-Free Income

Most income received from your employer generally ends up on a W-2 tax form at year's end. However, some income... read more

Tax-Loss Harvesting

Tax-loss harvesting, what the heck is that? Simply put, it is when you sell some investments at a loss to offset gains... read more

What is a Property Installment Sale?

Using an Installment Sale to Help Sell Real Estate and What to Look Out For

You may be able to benefit... read more

9 Ways Realtors Can Reduce Their Tax Bill

Do you know the 9 ways realtors can reduce their income tax bill? Is the IRS a dreaded agency that... read more

What the Heck is Backup Withholding?

If you are a taxpayer receiving certain types of income payments, the IRS requires the payer of these payments to... read more

The 2021 Child Tax Credit Update

The 2021 Child Tax Credit Update - Important changes to the Child Tax Credit (CTC) will help many families get... read more

Adopting? You Might Benefit from This Special Tax Credit

Are you adopting? You just might benefit from this special credit. Here is some information you should know. What exactly... read more

The American Rescue Plan Passed!

The American Rescue Plan passed and will be signed into law at the end of the week. Here's a... read more

Yes! These Things May Be Taxable

You already know that your wages are taxable. Here are some other things that may be taxable. 1. Scholarships - If... read more

Employee or an Independent Contractor?

Employee or an Independent Contractor, sometimes it's hard to tell. Are you an independent contractor or an employee? As the pandemic... read more

The IRS IP Pin Program is Open

The IRS IP Pin Program is Open! The IRS has expanded their pilot program that uses Identity Protection Personal Information Numbers... read more

Tax ID Theft. Don’t Be A Victim.

Tax ID Theft. Don’t Be A Victim. Here are 7 Tips to Reduce Your Chances of Becoming a Victim of... read more

It’s Your Salary!

It’s Your Salary so who decides how much your paycheck should be? You or the IRS? You are the business owner.... read more

Stay Out of Tax Trouble

Stay Out of Tax Trouble By Avoiding These 5 Common Tax Filing Mistakes

Whether you file a simple 1040EZ or a... read more

Ten Tax Facts to Know If You’re Selling Your Home

Selling Your Home? Here are Ten Tax Facts to Know Generally, the gain from the sale of the house is... read more

Working From Home Best Practices

Tax Forms: How to Store Them, How to File Them and How to Reduce Your Liability

Working from home can be... read more

Newly Retired? You could be in for a tax surprise?

You've worked your entire life. You’ve got your retirement all planned out. Your retirement savings accounts are where you wanted... read more

Takeaways on Coronavirus Tax Changes

In response to the coronavirus pandemic, the IRS has implemented numerous changes that go well beyond tax filing extensions and... read more

Paycheck Protection Program Overview

This article is an overview of the Payroll Protection Program or PPP, which is just one of the loans available... read more

Corona Disaster Loan Help

SFS Tax & Accounting Services has an update on financial help and the latest on the Corona COVID-19 drama with... read more

Hiring a Tax Preparer? Here are some tips…

Tax season is here, and you may be seeking someone new to prepare your tax return. However, remember that you,... read more

Unfiled Tax Returns – What to do?

I have unfiled tax returns. What should I do?

Seven million taxpayers failed to file their taxes in 2014. Are you... read more

IRS Increases Tax Deductions for 2020

The IRS recently announced the list of increased tax deductions for 2020. The Internal Revenue Service recently issued its annual inflation... read more

IRS Increases 401K Contribution Limits for 2020

The IRS Increases 401K Contribution Limits for 2020. As part of its annual inflation adjustments, the Internal Revenue Service announced... read more

Is the Charity You are Donating to Legit?

One of the positive effects of donating (money) to a charity is simply feeling good about giving. Your ability to... read more

Resolve Your Back Taxes… 8 Reasons to Work with a Certified Tax Resolution Professional

Resolve Your Back Taxes…8 Reasons to Work with a Certified Tax Resolution Professional When you owe money to the IRS, it... read more

Five Federal Income Tax Breaks for Adult Students

Five Federal Income Tax Breaks for Adult Students

Here are Five Federal Tax Breaks for Adult Students... read more

16 Life-Changing Events That Can Impact Your Taxes

Throughout your life, there will be certain significant occasions that will impact not only your day-to-day living but also your... read more

The Marriage Penalty Tax is Still Around

The marriage penalty is still alive and well.

If you're changing your filing status in 2019 because of marriage, divorce, or... read more

Real Estate Agents: Updated List of Available Deductions

Real Estate Agents: Updated List of Available Deductions

For busy real estate agents who manage their own finances, it... read more

Where’s My Tax Refund? The Myths…

Where’s My Tax Refund? Now that the April tax-filing deadline has come and gone, many taxpayers are eager to get details... read more

Tax Law Tips for Truckers in 2019

Tax Law Tips for Truckers in 2019

When President Trump signed the Tax Cuts and Jobs Act of 2017 it... read more

10 Times When Only a Tax Professional Will Save You

10 Times When Only a Tax Professional Will Save You

The Limitations of DIY Tax Preparation...

read more

The 2019 IRS “Dirty Dozen” List of Tax Scams

2019 “Dirty Dozen” List of Tax Scams

The Internal Revenue Service wrapped up its annual "Dirty Dozen" list of... read more

Bitcoin: Property You May Have Forgotten is Taxed

Even though Cryptocurrency was originally proclaimed anonymous, transactions today are transparent. Governments have observed surges of black-market trading using Crypto... read more

5 Tax Tips for the Self-Employed

Freelancers and independent contractors face unique challenges during tax season. Here are some quick tips to better manage...

read more

What is the Earned Income Tax Credit? Do I Qualify?

What is the Earned Income Tax Credit? Do I Qualify?

The Earned Income Tax Credit (EIC or EITC) is... read more

Tax Breaks for the Military Family

Tax Breaks for the Military Family There are certain tax breaks available to members of the U.S. military and their dependents:

Sale...

read more

Are you an Employee or Independent Contractor?

Here's Why You Need to Know Oftentimes, businesses are hiring employees and handing them 1099 Forms to save themselves money. They... read more

Homeowner Alert! Review Your Tax Forms

Homeowner Alert! Review Your Tax Forms

New Tax Rules are Creating Confusion

Tax laws are constantly changing.... read more

How to Organize Your Business Documents

How to Organize Your Business Documents

For even the smallest of businesses, getting organized involves a lot more than... read more

Reasons Why You Should Hire an EA

Reasons Why You Should Hire an EA

Every year, millions of taxpayers decide to perform complex tax preparation by... read more

Do I Qualify as Head of Household?

Do I Qualify as Head of Household?

We know that selecting the correct status can get confusing. The Internal... read more

Are Your Cannabusiness Profits Going up in Smoke?

Are Your Cannabusiness Profits Going up in Smoke?

With tax season starting, questions from both legal and illegal cannabis... read more

6 Ways to Get Your Tax Refund Faster

6 Ways to Get Your Tax Refund Faster

As the tax filing season approaches, there are steps you can... read more

Small Businesses: Tax Act Changes

We’ve spent the last 10 months combing through the 100+ page Tax Cuts and Jobs Act (TCJA) of 2017. There... read more

4 Tips on Safely Donating Online

4 Tips on Safely Donating Online

We live in very unsettling times — at least from the standpoint of... read more

Employers: New Tax Credit Benefits for Those Who Provide Paid Family and Medical Leave

The tax reform legislation enacted in December 2017 offers a new tax credit for employers who provide paid family and... read more

Understanding Income Tax Refund Loans and Back Taxes

Understanding Income Tax Refund Loans and Back Taxes

Do you file your taxes electronically? If you do, and the... read more

Retirees Not Withholding Enough

Retirees Not Withholding Enough

The IRS has announced that retirees may not be withholding enough for taxes this year.... read more

You’ve Asked About Crypto Tax

Is Crypto to Crypto Taxable?

Crypto income is taxed differently. It mainly depends on whether you're buying and selling coins or mining them. All crypto... read more9 Tax Deductions Every Real Estate Agent Should Know

9 Tax Deductions Every Real Estate Agent Should Know

Tax season is coming up soon, and if you’re a... read more

Tax Reform Brings Changes to Fringe Benefits that can Affect an Employer’s Bottom Line

Tax Reform Brings Changes to Fringe Benefits that can Affect an Employer’s Bottom Line

The Tax Cuts and Jobs... read moreHelping Taxpayers Understand Different Filing Statuses

Helping Taxpayers Understand Different Filing Statuses

Getting ready for tax return season, but unsure of how to file? Married?... read moreSalvage Your Sunken Uncollectable Debt

Victims of reneged payment agreements might have a tax deduction

Let’s face it – it’s always frustrating not being... read moreSmall Businesses: Tax Tips for the Freelancer

Small Business: Tax Tips for the Freelancer

If you are an employee, you most likely pay little attention to... read more

IRS Extends Deadlines for Victims of Hurricane Michael

IRS Extends Deadlines for Victims of Hurricane Michael

Hurricane Michael victims in parts of Florida and elsewhere now have... read moreDo I Have to Pay Estimated Taxes?

Who Must Pay Estimated Taxes

Do I have to pay estimated taxes? This is a normal question to ask, but... read moreClean Up Your (Tax) Act: Small Business Edition

Organizing Your Tax Documents

Having a small business and filing your taxes is a whole lot different from filing personal taxes... read moreClean Up Your (Tax) Act

Organizing Your Tax Documents Let’s be honest, sometimes we’re all a little messy and unorganized. Life was much easier as a kid,... read more

Crypto: The Basics

What is Cryptocurrency?

Virtual currency (or crypto currency) is a medium of exchange using cryptography to secure transactions and... read moreMoney Alert: Your Tax Checkup

Here’s something the public generally turns a blind eye towards… your yearly tax changes. Have you used the Tax Withholding... read more

How Does the Tax Cuts & Jobs Act Affect Small Businesses? Part Three: What it Means For Your Clients

In part one of this series, we covered how the Tax Cuts & Jobs Act affects you as a small... read more

Finally! A Tax Debt Resolution Option

AN OFFER IN COMPROMISE

If you’re having trouble affording payments to the IRS to settle any outstanding debts, consider... read moreA Plan a Day Keeps the IRS away: Back Taxes

The IRS is considered the most brutal collection agency on the planet – backed by the power of the federal... read more

Are You Making One of These Four Tax Mistakes?

The world of taxes is one big minefield to navigate. Unless you spend most of your waking hours studying it... read more

How Does the Tax Cuts & Jobs Act Affect Small Businesses? Part Two: Your Deductions

In part one of this three-part series, we looked at changes to the income tax rates and brackets. Income is only... read more

Top Five Tax Cuts and Jobs Act Tax Planning Opportunities for Individuals in 2018

Since folks have not filed a 2018 tax return, the new tax law passed late last year is largely a... read more

Attention Truckers: Tax Deadline Directly Ahead

Look out! We’re down to just five days to file Form 2290 (also known as the Heavy Highway Vehicle Use... read more

How Does the Tax Cuts & Jobs Act Affects Small Businesses? Part One: Your Income

The most sweeping change to tax law in decades was ushered in late in December of 2017. The Tax Cuts... read more

What’s new in the SFS Tax office – August 17

Today I am sharing a bit of "What's new in the SFS Tax office." We are pleased to announce that we... read more

Are You or Someone You Love Going to College?

Find Out About Tax Credits that Can Help Offset the Cost

There is no doubt that the cost of college can... read more

Dog Days of Summer

That Means Extended Tax Deadlines are Coming! Give Yourself Time to Avoid These Common Mistakes Air conditioners everywhere are feeling the... read more

Helping Students… Or a Nasty Surprise?

Student Loan Forgiveness Can Create a Big Tax Debt. Student loan debt levels are out of control. Need proof? The class of... read more

Starting a New Business?

10 Things You Need to Know. To be in charge of your own destiny – that is the dream of many... read more

Thinking of Renting Your Home?

There are Tax Consequences. With the rise of Airbnb (along with hotel prices), it’s not a surprising trend. Homeowners looking to earn... read more

Suing Over SALT?

Could We See a Reversal of the SALT Deduction Cap?On July 17, four states filed suit against the federal government... read more

Are You a Favored Business?

The New 20% Pass-Through Deduction Can Make a Big Difference in Your Tax Bill. One of the winners from the... read more

Is it a Hot Dog, a Sandwich, or a Flying Superhero? National Hot Dog Day, Taxes & Life as We Know It

As we reflect on the ubiquitousness of hot dogs in American life – they are all over our sports stadiums,... read more

What is the “Sharing Economy” and Why Should I Care?

Ever thought about becoming an Uber driver part-time? How about renting out a spare bedroom in your home? Maybe offering... read more

Look Out! The Taxes are Coming…

Supreme Court Decision Opens the Door for State & Local Internet Sales TaxesThings are about to change in the realm... read more

Did You Owe Taxes this Year? You Need a Paycheck Checkup!

If you wrote a check to the IRS in April for 2017 taxes, there’s a good chance you could be... read more

It All Started with a Tea Party

It was probably cold the night of December 16, 1773. Three ships – the Beaver, the Dartmouth, and the Eleanor –... read more

It Can be Costly to Ignore 1099 Requirements

With changes and updates happening to the tax law continually, it can be hard to stay up-to-date. For business owners... read more

Say Goodbye to Unreimbursed Employee Expenses

Medical professionals paying out of pocket for their uniforms. Road warriors who don’t get the federal mileage rate from their... read more

Plan Now, Pay Less Later

What is Tax Planning and Why Do I Need It?

The only constant is change. That applies just as much to... read more

3 Summer Financial Tips for Kids

Ahhh… summer! Enjoy a more relaxed schedule, warmer weather, backyard barbeques and sandy-yet-fun trips to the beach. In between all... read more

Do You Make Quarterly Tax Payments?

It's a Little Trickier This Year. Figuring out quarterly tax payments is a little more complicated this year. The Tax Cuts... read more

Senior Financial Fitness

What You Need to Know. It’s never too late to get financially fit. Here are some simple and painless ways to... read more

Standard Deduction & Child Tax Credit Doubles, Personal Exemptions Vanish

Part Two of What did the Tax Cuts & Jobs Act Do to My Income Tax?

Standard Deduction &... read more

What Did the Tax Cuts & Jobs Act do to My Income Tax?

Many changes were ushered in by the Tax Cuts & Jobs Act which passed in December 2017. Depending on... read more

Another Hurricane?!

A Hurricane Tax Holiday. Many of us remember the wrath of Hurricane Irma last September. It seems like yesterday! It can... read more

Top 5 Ways Wine Helps with Your Taxes

In honor of National Wine Day, we’re counting down the ways that wine can help you when it comes to... read more

Tax Avoidance vs. Tax Evasion

Which One is Legal? (The IRS Said So) Everyone knows you’re supposed to pay your taxes. If you don’t, that’s illegal.... read more

All About Tips

All About Tips (The Kind You Give at Restaurants). An SFS Tax & Accounting Services Blog. This shouldn’t be news to... read more

New Twist on an Old Scam

IRS Warns of Crooks Directing Taxpayers to IRS.gov to "Verify" Calls. IRS scams are like cockroaches. You kill all you find, but... read more

Why do We Pay Taxes Anyway?

Why do We Pay Taxes Anyway? No one likes paying taxes. It’s easy to focus on that check you write to the... read more

It’s Not Just About April 15th

IRS Tax Deadlines Happen All Year Long. A lot of focus and attention is paid to April 15th (17th this year)... read more

Extra Time to FileTax Return

Everyone knows to file an extension if they need more time to prepare their tax returns. (Of course, you don’t... read more

Are You Taking Home Too Much Money?

Do a Paycheck Checkup and See If You Are You Taking Home Too Much Money The Tax Cuts and Jobs Act... read more

Watch Out for Ghosts…

Ghost Tax Preparers, That Is! The IRS has issued a warning against “ghost” tax return preparers. These phantom preparers do exist… and... read more

Top Five Tax Myths

Top Five Tax Myths and the truth. It doesn’t matter what your friend’s cousin’s co-worker said. When it comes to taxes,... read more

Rushing on Your Taxes?

The IRS Recommends Filing an Extension if You Need One. With about a week to go on filing your 2017 tax... read more

Can’t File Your Tax Return in Time?

Don’t Panic! Here’s What You Need to Know About Extensions. Life gets in our way sometimes. When those W-2s, 1099s, 1098s... read more

Hurry! $1.1 Billion in 2014 Tax Year Refunds Will Expire April 17

Did you forget to file your tax return for 2014? If so, you might want to. There is $1.1 billion... read more

Sold Your Home?

Here's What You Need to Know About Taxes. Congratulations on selling your home! After you break out the bubbly and toast... read more

Good News for the Sandwich Generation? Claiming Parents as Dependents

Mom and Dad are getting older. They may even be relying on you for support. That’s why it’s good to know... read more

Don’t Get Shocked with a 2018 Tax Bill

Get Your Paycheck Checkup Now! As we wind down on the 2017 tax season, there’s another one gearing up. The... read more

It’s Not too Late to Get Your Qualified IRA Contribution Deduction

It’s not too late! You have until April 17, 2018 to make a qualified IRA contribution to receive a 2017... read more

10 Tax Deductions that Border on Ridiculous

We all need a little humor during these dog days of the tax season. Each year, the Minnesota Society of... read more

Owe Taxes but Can’t Pay? Here’s What to Do!

You can feel the pressure. The tax deadline is looming and you know you owe the IRS money. Problem is,... read more

Beware the Ides of March! The First Tax Return Deadline is Today

If only William Shakespeare could have traveled back in time to early 44 B.C. He would have been able to warn... read more

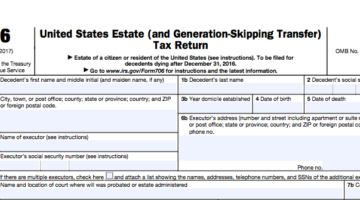

Death and taxes… and what you need to know

As you may or may not know, my younger sister recently passed away and Ali and I just returned from... read more

Corporate Due Dates… And spring (training) is in the air

Well, my friends, it is now March, and baseball spring training is back in full (ahem) swing. Not sure why... read more

Scammers Are Using Your Bank Account to Rob the IRS

Scammers Are Using Your Bank Account to Rob the IRS. Did you notice a large deposit in your checking account from... read more

What the Polar Bear can Teach us about the IRS

Today is International Polar Bear Day. In its honor, we are ruminating on how a polar bear is like... read more

Scammers Continue to Target TurboTax Users in 2018

TurboTax users beware! That email asking you to take a look at your W-2 may be fake. People who use TurboTax... read more

Don’t Fall for These 5 Tax Refund Myths

It's tax time again! It's that time of year when those expecting a tax refund watch their bank accounts like... read more

Keep an eye out for the new W-2 Phishing Scam.

There are many people phishing in fraudulent waters trying to bait you. Business owners the W-2 scam has reared its... read more

This week it’s all about, me, Your Tax Professional

This week it’s All About, Me, Jeffrey Schneider, EA, CTRS, Your Tax Professional! I recently had the distinct honor of being... read more

Tax Cuts and Jobs Act of 2017 and What You Need to Know

Yep, it's Monday and not Thursday but last week was a busy one and I wanted to share this information... read more

Don’t knock yourself out!

Don't Knock Yourself Out! Get help from SFS Tax. In my last letter to you, my fellow Green Thumbers, I... read more

Post Halloween Scammers

Post Halloween Scammers Now that Halloween is over and the ghost and goblins costumes have gone back into storage, you need... read more

Everything You Need to Know… Hurricane Harvey and Irma Relief

Everything You Need to Know… Hurricane Harvey and Irma Relief As our communities work to recover from Hurricanes Harvey and Irma,... read more

IRS Offers Tax Filing Relief to Hurricane Irma Victims in Florida

IRS Offers Tax Filing Relief to Hurricane Irma Victims in Florida. SFS Tax & Accounting Services Helps Florida Affected Taxpayers. The... read more

6 Tax Tips for Startup Businesses

6 Tax Tips for Startup Businesses Taxes are rarely the first thing an entrepreneur considers when they plan a new business.... read more

Understand Your Responsibilities

**Understand your responsibilities Settlement of a debt is not the end of the story. Creditors who forgive $600 or more of your... read more

The Top 3 Apps to Track Your Business Miles

The SFS Tax & Accounting Top 3 Apps to Track Your Business Miles… You need to keep a log if you... read more

Big Changes for the 2017 – 2018 FAFSA

Big Changes for the 2017 – 2018 FAFSA If you have a child beginning college or already enrolled in school you... read more

Are You Making This Common Mistake and Will it Hurt You at Tax Time?

Are You Making This Common Mistake and Will it Hurt You at Tax Time? Using your company credit card for personal... read more

SFS Offers Tips for Teenage Taxpayers with Summer Jobs

SFS Offers Tips for Teenage Taxpayers with Summer Jobs Summertime is here, and many students and teenagers get summer jobs to... read more

5 Overlooked Medical Tax Deductions?

Do You Know About These 5 Overlooked Medical Tax Deductions? It’s getting more and more difficult to claim medical tax deductions.... read more

Extension, procrastinator…Who me?

Extension, procrastinator…Who me? Are you one of those “wait till the very last minute” type of people” better known as a... read more

Another New Warning on a Scam!!

Yet Another New Warning on a Last-Minute Tax Scam!! It seems that we receive notices almost daily about new and more... read more

Beware the Ides of March

Beware the Ides of March William Shakespeare famously wrote “Beware the Ides of March” in the play Julius Caesar in 1599... read more

Using Tax Software is not a Substitute for an Enrolled Agent

Using Tax Software is not a Substitute for an Enrolled Agent

The tax software companies want you to believe that... read moreCan You Claim Your Parents as Dependents?

Can You Claim Your Parents as Dependents?

With so many millennials moving back home with mom and dad, the question... read moreDon’t Fall for Scam Calls and Emails Posing as IRS

Don’t Fall for Scam Calls and Emails Posing as IRS

Scammers are continuing to use the IRS as a lure... read moreHow We Wound Up with the Income Tax

How We Wound Up with the Income Tax

Imagine a world without income tax; if you were an American citizen... read moreFiling Season Opens – with Possible Refund Delays

Filing Season Opens – with Possible Refund Delays

Port St Lucie, Fl. — (January 23, 2017) Tax filing season for... read moreLast-Minute Savings for Tax Year 2016

Last-Minute Savings for Tax Year 2016

Last-Minute Savings for Tax Year 2016 Attention last minute savers! There’s still time to reduce... read more

Are you reporting ALL your income?

IRS Defines Income.. Are you reporting ALL your income? The Internal Revenue Code defines income as “…all income from whatever source... read more

I received a notice from the IRS… Now what?

I received a notice from the IRS… Now what?

Receiving a notice in the mail from the IRS does not... read more

Energy Credit Can Help You Trim Taxes

Energy Credit Can Help You Trim Taxes Energy bills too high? You can trim your taxes and save on those bills... read more

Tax Saving Strategies for Parents

Tax Saving Strategies for Parents Do you have kids? Children may help reduce the amount of taxes owed for the year.... read more

Tax Tips about Filing an Amended Tax Return

Tax Tips about Filing an Amended Tax Return We all make mistakes so don’t panic if you made one on your... read more

IRS Warns Taxpayers to Guard Against New Tricks by Scam Artists

IRS Warns Taxpayers to Guard Against New Tricks by Scam Artists Following the emergence of new variations of widespread tax scams,... read more

Tax Tips for Starting a Business

Tax Tips for Starting a Business When you start a business, a key to your success is to know your tax... read more

How To Prepare for a Tax Audit

How To Prepare for a Tax Audit

By Jeff Wuorio For the Deseret News Published: Monday, April 13 2015 2:00 p.m.... read moreWarrior Pose — One way to help veterans with PTSD? Lots of yoga.

Warrior Pose — One way to help veterans with PTSD? Lots of yoga.

Yes, we are a Tax & Accounting... read moreREMINDER FROM YOUR LOCAL ENROLLED AGENT

REMINDER FROM YOUR LOCAL ENROLLED AGENT

YOU NEED TO FILE ON TIME EVEN IF YOU CAN’T PAY

Port St Lucie, Fl.... read moreThe Individual Shared Responsibilty Provision

The Individual Shared Responsibilty Provision

Just the Basics!

The individual shared responsibility provision requires that you and each member of your family... read moreAffordable Care Act Consumer Alert

Affordable Care Act Consumer Alert

Choose Your Tax Preparer Wisely

The IRS is urging taxpayers to choose their tax professional carefully... read moreSmall Business Health Care Tax Credit

Small Business Health Care Tax Credit

Do you own or run a small business or tax-exempt group with fewer than... read more

Cover Charge: How the ACA Is Affecting Fees

Cover Charge: How the ACA Is Affecting Tax Prep Fees On March 6, Jeffrey Schneider, EA, NTPI Fellow was quoted in... read more

Top 10 Special Tax Benefits for Armed Forces

The Top 10 Special Tax Benefits for Armed Forces If you are a member of the U. S. Armed Forces, here... read more

Same-Sex Newlyweds Will Be Filing Tax Returns In A New Way

Same-Sex Newlyweds Will Be Filing Tax Returns In A New Way Washington, DC, (February 17, 2015) Despite Alabama Chief Justice Roy... read more

Check Credentials Before You Hire a Tax Pro

Before You Hire a Tax Pro, Check Credentials

Port St Lucie, FL, February 23, 2015—Although you may not have received all...

read more

Port St. Lucie Enrolled Agent is accepted into the ASTPS

Port St. Lucie Enrolled Agent is accepted into the ASTPS Jeffrey Schneider, EA, NTPI Fellow, a Port St. Lucie, EA has... read more

Eight Honored at the 2014 NAEA National Conference

Eight Honored at the 2014 NAEA National Conference - Port St Lucie Businessman Receives Education Award Washington, DC — (August 18,... read more

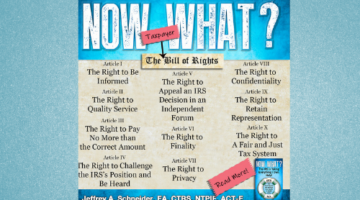

IRS Adopts “Taxpayer Bill of Rights”

IRS Adopts "Taxpayer Bill of Rights" The Internal Revenue Service has announced the adoption of a “Taxpayer Bill of Rights”... read more

Largest Ever Phone Fraud Scam

IRS Warns Taxpayers Warn of “Largest Ever Phone Fraud Scam” The Treasury Inspector General for Tax Administration, J. Russell George, warned... read more

Telephone Tax Scams Increase

A sophisticated phone scam targeting taxpayers, including recent immigrants is on the rise throughout the country. Victims are told they owe... read more

Same-Sex Marriages Will Be Recognized

Treasury and IRS Announce That All Legal Same-Sex Marriages Will Be Recognized For Federal Tax Purposes The U.S. Department of the... read more

Payroll Tax Cut Extended to End of 2012

Payroll Tax Cut Extended to the End of 2012

The IRS released revised Form 941, enabling employers to properly report the newly-extended... read moreMore Time to Contribute to IRAs in 2012

More Time to Contribute to IRAs in 2012 You have two extra days this year to make contributions to your Individual... read more

Health Insurance Tax Breaks for the Self-Employed

Health Insurance Tax Breaks for the Self-Employed If you’re self-employed and paying for medical, dental, or long-term care insurance, the IRS... read more