Many changes were ushered in by the Tax Cuts & Jobs Act which passed in December 2017. Depending on your tax situation, the most impactful changes for individuals were to:

- Ordinary Income Tax Rates and Brackets

- Standard Deduction Amounts

- The Personal Tax Exemption

For those with children, the doubling of the child tax credit can also make a difference.

In the first of this two-part series, we’ll look at the changes to the ordinary income tax rates.

Income Tax Changes: Most Will Pay Less, Some will Pay More (and Some will Stay the Same)

It was widely reported that the Tax Cuts & Jobs Act lowers ordinary income individual tax rates.

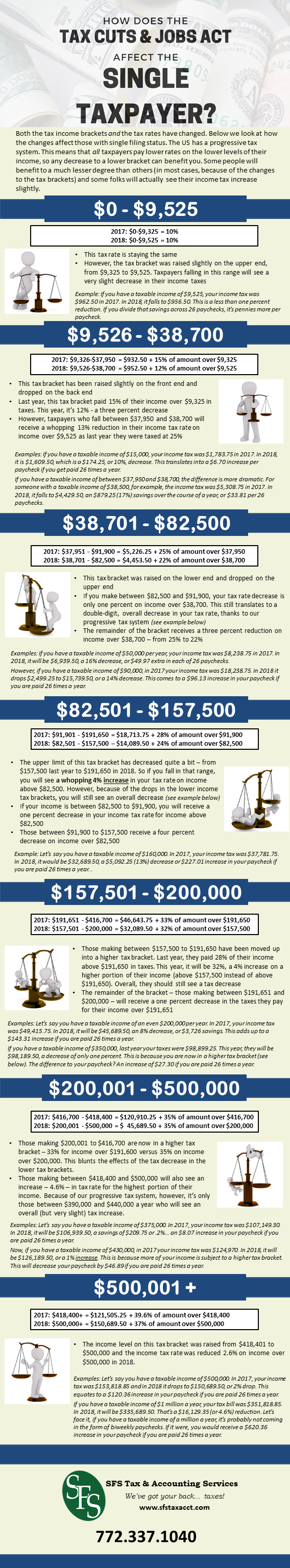

A closer look reveals that, while some — not all – tax rates are going down, the income brackets have also shifted. Those tax rate decreases are not the same across the board, either. This leads to varying effects on different levels of income.

What does this mean?

- Most Americans will see a tax cut on their ordinary income. However, not all will be seeing the same degree of tax cut. (It ranges from less than one percent to double-digit decreases).

- Some American’s tax rates have stayed the same. For those making $9,325 and under, there is no income tax cut.

- Still others will see an increase in their effective tax rates (the tax rate you actually pay) because of the changes to the income tax brackets. These affect higher-income taxpayers and are very minimal increases (less than one percent).

This is in line with the Tax Policy Center’s finding that around 80% of Americans would receive (some degree of a) tax cut under the new law.

How will the Average American Do?

According to the U.S. Census Bureau, the median annual personal income was $31,099 and the average household income was $59,000 in 2016.

Let’s say those numbers are still good today.

- Single individuals making $31,099 will see a 16% decrease in their 2018 tax rate.

- Married individuals filing jointly with a household income of $59,000 will see a 15% decrease.

If you haven’t noticed your tax cut in your paycheck, most likely it’s because those decreases are divided out between 26 paychecks (or 24 in some cases).

- For single individuals making $31,099, they would only see a $25.28 per paycheck increase if they are paid biweekly.

- For married individuals filing jointly, it’s only $46.87 more per paycheck if they are paid biweekly.

This would be the reason you haven’t seen too many average Americans dancing in the streets over tax rate cuts.

How does income tax work anyway?

In the United States, we have a progressive tax system. That means higher income taxpayers pay a higher income tax rate.

But it’s not quite that simple.

All taxpayers pay lower rates on the lower levels of their income, so even those in the highest brackets will benefit from a decrease to the lower rates.

For example, single taxpayers in 2018 will pay:

- 10% on the first $9,525

- 12% on dollars 9,526 to $38,700

- 22% on the dollars $38,701 to $82,500

- 24% on dollars $82,501 to $157,500

- 32% on dollars $157,501 to $200,000

- 35% on dollars $201,000 to $500,000

- 37% on dollars $500,001 and above

Example – Single Taxpayer with a $550,000 Taxable Income

Let’s say our single female taxpayer earns $550,000 in taxable income (good for her)! Now, this taxpayer will not pay 37% on the full $550,000. Instead, she will pay the following:

- $0 to $9,525 = 10% = $952.50

- $9,526 to $38,700 = 12% = $3500.88 on this portion of income ($29,174)

- $38,701 to $82,500 = 22% = $9635.78 on this portion of income ($43,799)

- $82,501 to $157,500 = 24% = $17,999.76 on this portion of income ($74,999)

- $157,501 to $200,000 = 32% = $ 42,499 on this portion of income ($42,499)

- $201,000 to $500,000 = 35% = $104,650 on this portion of income ($104,650)

- $500,001 to $550,000 = 37% = $18,499 on this portion of income ($18,499.63)

TOTAL TAX = 197,737.60, or 36% of $550,000 income

Although she falls into the 37% tax bracket, her effective income tax rate (what she actually will pay) is 36%.

Why? Because the lower levels of her income are taxed at lower rates.

Let’s use one more example of a single male taxpayer making a more taxable income of $50,000.

Example – Single Taxpayer with $50,000 in Taxable Income

- $0 to $9,525 = 10% = $952.50

- $9,526 to $38,700 = 12% = $3,500.88 on this portion of income ($29,174)

- $38,701 to $82,500 = 22% = $2,485.78 on this portion of income ($11,229)

TOTAL TAX = 6,939.16, or 14% of a $50,000 taxable income

This taxpayer is benefiting much more from the lower tax rates of the first two income tax brackets.

Why? Because the majority of his taxable income falls into a lower tax rate bracket.

He is paying an effective tax rate of 14% even though he is in the 22% tax bracket.

Although our higher income taxpayer is reaping some benefit from those lower tax brackets, the lower income taxpayer is reaping more – much more.

How does this compare to 2017?

To illustrate how the tax cuts play out in 2018 versus 2017, see infographic below. For the sake of brevity, we are only looking at the effects to the single taxpayer.

What’s the Bottom Line?

There weren’t just changes to the tax rates (in some cases).

There were also changes to the income ranges in each tax bracket.

Overall, there are decreases in the rates for everyone who files single status of over $9,325 income.

There’s a slight increase in taxes for single folks making between $390,000 and $450,000 (which would most likely be barely noticeable at that level of income).

Oddly, those making over $500,000, however, will see decreases in their tax rate. These decreases get higher as their income rises.

Get the Whole Story

Of course, how many of us just pay the tax rate on the tax table?

The answer is that none of us do.

All of us either take standard deductions or itemize to lower our taxable income. Up until now, we could also take personal exemptions. However, that has been eliminated in the new tax code.

We’ll take a more complete look at how the Tax Cuts and Jobs Act will affect you in part two, where we will analyze the changes to the standard deductions, personal exemptions, and the child tax credit.

In the meantime, know that there are ways to reduce the taxes you pay – no matter where you fall on the income scale.

See your tax professional to find out how to take action now for a lower tax bill come April 2019.

************************************************

Jeffrey Schneider, EA, CTRS, NTPI Fellow has the knowledge and expertise to help you reach a favorable outcome with the IRS. He is the head honcho at SFS Tax & Accounting Services as well as the Enrolled Agent and Certified Tax Resolution Specialist for The Tax Relief Company

************************************************

Now What? I Got A Tax Notice From The IRS. Help! Defining and deconstructing the scary and confusing letters that land in your mailbox. Jeff defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what is what in the world of the IRS.

The book is available in paperback and ebook on https://Amazon.com

************************************************

For more on SFS Tax & Accounting Services, visit https://sfstaxacct.com/

************************************************

738 Colorado Avenue Stuart, FL 34994

************************************************

Phone: 772-337-1040

************************************************

https://twitter.com/SFSTax/

https://www.linkedin.com/in/jeffreyschneiderea/

************************************************

Leave a Reply