2020 Mileage Rates Announced

Dear Fellow Taxpayers, Better late than never. On December 31, 2019, the IRS issued the standard mileage rates for 2020. The Internal... read more

Tax Law Changes That Affect Your Taxes

Dear Fellow Taxpayers, Tax law changes that can affect your 2018 0r 2019 taxes - On Friday, December 20th, a new... read more

Important RMD changes! The SECURE Act.

Hello, Fellow Taxpayers, This letter is Really Short and Sweet, and will most likely be my last email until the new... read more

The 2020 tax filing season is almost here

Hello fellow taxpayers,

October 25, 2019 - SFS is gearing up for the 2020 tax filing season.

The 2020 tax filing season... read more

Social Security Annual Update and Increase

Hello, Fellow Taxpayers, October 18, 2019 - The Social Security Administration has announced the following changes for 2020. Please feel free... read more

Mark your calendar – October 7,2019

Hello Fellow Taxpayers, Although this email is a little off schedule, I thought it was best to get this to you... read more

Is certified mail the way to go?

Hello Fellow Taxpayers,

September 6, 2019 - Is certified mail the way to go?

My instruction letter to our clients recommends that... read more

IRS Tax Withholding Estimator – August 30, 2019

Hello Fellow Taxpayers, For those of you who wait with great anticipation for my weekly emails, I am sorry that I... read more

Rental Property – August 15, 2019

Hello fellow taxpayers, This week I am going to provide some information regarding rental property or rentals. The subject has recently... read more

Questions and Answers from Clients – June 14, 2019

Hello Taxpayers, As you read this, I am attending an event in Orlando. Many of you know that I travel for... read more

RIP Rainbow Dave – May 24, 2019

Hello Fellow Taxpayers,

I hope you have some fun plans for this weekend’s Memorial Day. Unfortunately, a good friend of the... read more

Tax Tip….RMD & QCD! – May 10, 2019

Hello Fellow Taxpayers,

Ali, Marissa and I are in LA attending our mastermind meeting in LA. However, I want to share... read more

New IRS Notice? – May 3, 2019

Hello Fellow Taxpayers,

This week, I was in DC attending the IRS Advisory Council meetings. My fellow members and I, work... read more

Forming New Companies – April 26, 2019

Hello Fellow Taxpayers.

The tax season crunch is over, at least for now. Next week I am starting my travels to... read more

What makes a lease a lease? – April 19, 2019

What can get truly ugly, my fellow taxpayers? A tax surprise!

Arthur E. Boyce claimed a $28,749 Section 179 deduction for... read more

Until We Meet Again… – April 12, 2019

Hello, My Fellow Taxpayers, I am writing this email during a brief lull in my last-minute craziness. There are only a... read more

Extension – March 29, 2019

Hello Fellow Taxpayers, April 15th is only 18 days away and your tax return is due by midnight on the 15th. Just... read more

Conclave – March 23, 2019

Hello Fellow Taxpayers,

Even if you are not a college basketball fan, you may have noticed that the NCAA is starting... read more

Foreign Account?? – March 14, 2019

Hello Fellow Taxpayers,

Over the past few days, a couple of situations occurred that I want to share with you. This... read moreWhat’s in a name?- March 8, 2019

Hello Fellow Taxpayers,

Have you ever gone to a restaurant and ordered a Coke, but the server said that they only... read moreCryptoCurrency – March 1 2019

Morning Fellow Taxpayers,

I was going to write about Triple Net leases and how they generally don't qualify for the 20%... read more8.4%?? – February 22, 2019

Hello fellow taxpayers

8.4%!!! What does this mean? If you have been listening to the news recently, all the pundits and the... read more1099? – February 15 2018

Hello Taxpayers!

Over the past week or so, several new clients have come in. Each handed me ONE 1099-MISC. This form... read more“GOAT”- Best EA- February 5, 2019

Hello Fellow Taxpayers,

Well, the GOAT has done it again. Though it was not the best played Super Bowl of all... read more199 Cap A- February 1 2019

Hello fellow taxpayers.

This is a short, LOL! but very important email. I am repeatedly asked about the 199 Cap A by... read morePatriots & Ram’s, Oh My!- January 25, 2019

Howdy folks,

Ali is home-bound and recovering. She saw her doctor on Tuesday for a post-op, and all is going according... read moreThe medical deduction man- January 18, 2019

Hello Fellow Taxpayers, I want to thank all of those who expressed well wishes when Ali went for shoulder replacement surgery... read more

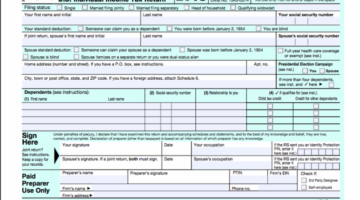

Tax Season – January 10, 2018

Tax Season is upon us

Hello, followers of my weekly email. I have missed the past couple of weekly communications. I... read more

Passport Problem- December 21, 2018

Hello my friends.

By the time you see this, Ali and I will be starting the last day of our cruise.... read moreMexico Bound- December 14 2018 letter

Happy Friday, my friends. Sorry that I missed an email last week. I am sure that you are all so disappointed. I... read more

Traveling- November 30, 2018

Hello, my friends, After a full week back in the office I can truly say that I loved having 4 days... read more

Thanksgiving- November 23, 2018

Hello, my friends, It's Friday morning, and you are all probably bursting from all the food that you “stuffed” yourselves with... read more

Patience- November 16, 2018

Hello my friends, Patience. Weren't we taught as a child that patience is a virtue? I am sitting at the airport in... read more

Family- November 8, 2018

Hello my friends, The elections are finally over which means the annoying ads and bad mouthing will stop. Well, maybe. Of... read more

Maternity Leave- November 2, 2018

Hello my friends,

Owning a business comes with a mass of responsibilities including awareness and understanding of all the new tax... read moreEducation- October 26, 2018

Hello my friends,

The dictionary defines education (noun) as: "Education is the process of acquiring the body of knowledge and skills that... read moreProcrastinator- October 19, 2018

Hello, fellow taxpayers,

Tax season 2018 is finally over!! (with the deadline for the extended returns being this past Monday, October... read more“Cyber-Safe” October 12, 2018

Hello, fellow computer users,

I was recently on a refresher webinar about cybersecurity regarding what must be done to secure our... read moreGo Yankees!- October 5, 2018

Hello, my fellow taxpayers,

I am writing this email on Thursday night, while I watch the Yankees play the A's. Right... read moreFall is here! September 28, 2018

Hello, my fellow taxpayers, Now that it is officially Fall (actually, it began on the 21st), Autumn, or the Autumnal Equinox... read more

Crypto- September 21, 2018

Dear Fellow Taxpayers,

Cryptocurrency, virtual currency, bitcoin, etherium. What do these terms mean? They are part of the new world of paying for... read moreHurricanes and Taxes, Oh Joy!

Hello, Fellow Floridians (and those that are not).

We hope that all of our friends, family, business associates that live or... read moreMeet our new staff member Sam!

Good Afternoon to All,

It has been a short week and I just returned from attending IRSAC meetings in Washington D.C.... read moreTax deadline coming up, do you have to file?

Hello Clients, Friends and Business Associates,

I am here in my office this entire week, can you believe it? This email is... read moreIRC §199A- August 10th

Hi, my friends, I am still alive and kicking. Why do I say that? It is because I have been in... read more

Ramblin’ Man- July 27

Hi Folks, "Lord, I was born a ramblin' man Tryin' to make a livin' and doin' the best I can And when it's... read more

Education- July 20th

Hi Folks, As many of you know from chatting with me, or you have read my posts on social media, I... read more

Tax Form Updates- July 13th

Hi Folks, It's Monday, and I am watching the Yankees get beat up in the make-up game against the Orioles. I have... read more

Independence Day- July 6th

To My Fellow Taxpaying Americans, As I write this email, I am watching the Yankees play the Braves. The read more

“Postcard” Tax Return- June 28

Hi Folks,

As I am 40,212 feet, just north of Savannah Georgia, traveling home from Bow, Washington, through Seattle with a... read moreEnrolled Agents- June 22

Hello folks, As you all know, I am an Enrolled Agent and very proud of that fact. I am also a member... read more

Marriage June 1, 2018

Hi Folks, As I was reviewing the newsletter that you received yesterday, it prompted the topic for my weekly email. The... read more

Always Traveling….and Jeff’s big ask!

Hi Folks, As most of you know, after tax season and a few days of well-deserved R&R I traveled to DC... read more

HSA- May 3, 2018

Hi Folks, I am here in DC for the Internal Revenue Service Advisory Council (IRSAC) meetings. Even in my travels, I... read more

End of Tax Season- April 19, 2018

Hello to all, Tax day has come and gone. I am at home recharging my batteries and energizing my brain after... read more

Paycheck Checkup- April 12, 2018

Hello Fellow Taxpayers, The Tax Cuts and Jobs Act made major changes to the tax law. Because of this, you should... read more

Tax Beak?- April 5, 2018

Hello Fellow Taxpayers, I am taking a short break to share some information with you that could affect your tax return. “I... read more

Missing PoPo- March 29, 2018

Hello Fellow Taxpayers, This will be a very brief email. Ali and I want to thank you for the heartfelt wishes everyone... read more

Between Appointments- March 22, 2018

Hello All, What Does Jeff do between tax appointments? Provided by the "current" staff at SFS Tax & Accounting Services… It’s 26 days... read more

FOF?!?- March 15, 2018

Hello Ali, Happy Ides of March! Julius Cesar’s last act was not to heed the warnings of his impending assassination that was... read more

Death and Taxes- March 8, 2018

Hello All, As you may or may not know, my younger sister recently passed away. Ali and I just returned from... read more

Spring is in the Air- March 1, 2018

Hello All, Well, my friends, it is now March, and baseball spring training is back in full (ahem) swing. Not sure... read more

Persistence- February 22, 2018

Hello All, Have you ever started a project that seemed to go smoothly and quickly, then it hits a snag?... read more

Feeling the Love- February 15, 2018

Hello All,

I hope you had a great St. Valentine’s Day and enjoyed a meal in a nice restaurant. Ali and... read moreFull Tax Season Mode

Hello All, February 8, 2018 - Welcome to tax season, 2018. I finally recovered from a sore back which I believe was... read more