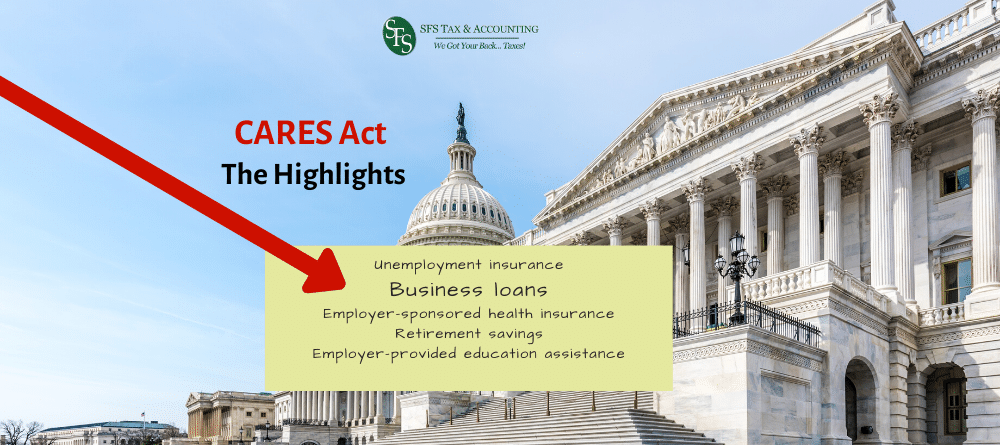

This article is an overview of the Payroll Protection Program or PPP, which is just one of the loans available under the new legislation.

What is the Paycheck Protection Program?

The PPP is an emergency loan program intended to allow borrowers to continue to make payroll and pay other “allowable” costs over an eight (8) week period. The deadline for obtaining a loan under the Program is June 30, 2020.

- Your business needs to have been impacted by COVID-19. This can include staffing problems, revenue challenges, supply chain challenges, or the closing of an office.

- This is broadly defined and has no limitation as to whether you are or are not still profitable — or even now making more money — only that you are impacted by the pandemic.

Within the new legislation are loans to be given out to small businesses (under 500 employees) that have the ability to be forgiven if certain criteria are met.

- The amount of the loan will be based on “payroll costs,” which include wages up to $100,000 per employee (annualized), health insurance costs, an employer covered 401k costs and even some subcontractor costs.

- Owners that are paid W2 wages are included in this calculation (but capped at $100,000, just like all others).

The fund can provide loans of up to $10 million, with a maximum loan equal to 250% of your average monthly payroll costs (companies with seasonal workforces can apply as well, with slightly different stipulations).

- The terms of the loans are supposed to be ten years at a maximum of 4% annual interest rate, with no principal payments required for six months.

- There will be no personal guarantees and no collateral required, and also no origination fees.

Paycheck Protection Program loans will be forgiven if:

- You use all the funds for “qualified uses” for the next eight weeks from the date the loan is taken. (Qualified uses include payroll, mortgage interest, rent, and utilities.)

- Your number of full-time equivalent employees is not reduced. (The reduction calculation compares the number of full-time employees during the eight-week period with a similar timeframe from 2019.)

- As many of you know, loan forgiveness is typically taxable income. However, there is a special provision that this loan is forgiven will also not be taxable income to the company.

If a portion of the loan is not forgiven, it is then going to exist as a 10-year 4% loan (or whatever terms that are agreed to.

Understand that you will eventually need to prove the funds were used for the “qualified purposes” set forth above in order to get the loans forgiven.

How do you determine if payroll was paid from these funds and not from the current profits of the company or from old cash reserves?

- There is no specific guidance on this yet. You could set these funds in a separate checking account and use that checking account only for qualified expenses. This will make sure that the use of funds is traceable to the allowed costs.

You need to act fast; these loans will be gone soon.

Call us today for help in preparing the SBA Loan Disaster Package and Application NOW! Call 772-337-1040 and speak with Jeff.