The most sweeping change to tax law in decades was ushered in late in December of 2017. The Tax Cuts & Jobs Act has many provisions that affect small businesses… and their clients.

Let’s look at your income first.

Lower Income Tax Rates

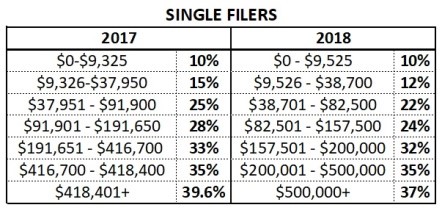

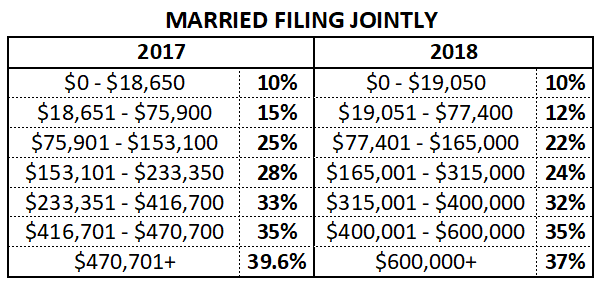

Income tax rates have been lowered for all but two income tax brackets.

The tax cuts in (most but not all) of the brackets are obvious. What’s more subtle are the effects of the shifts to the income tax brackets themselves.

Because of those shifts, some folks will fall into lower or higher tax brackets this year, with some clear winners (and losers).

Tax Bracket Winners

- Good news for those making between $9,325 and $9,525. They are now in a lower tax bracket and will get a 5% reduction (for married filing jointly, incomes between $18,650 and $19,050).

- The same goes for single filers with incomes between $37,950 and $38,700 as well as married filing jointly with incomes of between $75,900 and $77,400. They will now be in the second lowest tax bracket and will experience a whopping 13% reduction in their income tax rate.

- Incomes between $157,500 and $191,650 for single filers and $165,000 and $315,000 for married filing jointly will receive a four percent reduction due to the revised tax brackets.

- Those married filing jointly with between $233,351 and $315,000 in income get a healthy 9% cut in their income tax rate, as these lucky folks move from the third highest tax bracket to the middle. (There is no similar move for single filers).

- Single filers making between $418,401 and $500,000 will now enjoy a 4.6% income tax cut.

Tax Bracket Losers

- Single filers making between $82,500 and $91,900 are now in a higher bracket and will receive only a 1% decrease in their income tax rate (versus 3% for others staying in the original tax bracket).

- Those making between $157,500 and $191,652 as a single filer will be paying six percent more.

- Single filers making between $200,000 and $418,400 will pay 3% more. (Very strange, when those above $500,000 are getting a 2.6% cut in their income tax rate).

- Those making between $418,400 and $500,000 as a single filer will pay 2% more. (It’s worth it to try to increase your income here… you’ll get a 2.6% cut if you hit $500,001).

- Interestingly, there is no downside for married filing jointly – all tax brackets are higher on both ends. This means that married couples can earn any income, enjoy a lower tax rate, and in some cases fall into a lower tax rate as well. (Is it time to put a ring on it, perhaps)?

One thing to note: we have a progressive system, meaning that you pay the lower tax rate on lower levels of income. Even if you’re in a higher tax bracket, you’ll pay the same rate as everyone else on the first $9,525 of your income, as well as the $9.526 to $38,700, and so on.

What your final tax bill will be depends on your personal financial situation, including the deductions you are permitted to take.

See an Enrolled Agent for an accurate estimate of what you will owe for 2018, as well as expert advice on how to lower your tax bill.

Many Moving Parts

As you will see, how the Tax Cuts and Jobs Act will affect you is largely dependent on your unique situation. It’s not as cut-and-dried as an across-the-board tax cut.

In fact, due to new deduction limitations and eliminations (such as the $10,000 state and local tax deduction cap), some folks will find themselves with a larger tax bill when it’s all said and done for 2018.

In parts two and three of this series, we’ll take a closer look at the SALT deduction cap, how your other deductions may be affected, and how the new Tax Cuts & Jobs Act bill may affect the your tax bill and your client’s wallets.

************************************************

Jeffrey Schneider, EA, CTRS, NTPI Fellow has the knowledge and expertise to help you reach a favorable outcome with the IRS. He is the head honcho at SFS Tax & Accounting Services as well as an Enrolled Agent and a Certified Tax Resolution Specialist.

************************************************

Now What? I Got A Tax Notice From The IRS. Help! Defining and deconstructing the scary and confusing letters that land in your mailbox. Jeff defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what is what in the world of the IRS.

The book is available in paperback and ebook on https://Amazon.com

************************************************

For more on SFS Tax Problem Solutions, visit: http://sfstaxproblemsolutions.com/

For more on SFS Tax & Accounting Services, visit https://sfstaxacct.com/

************************************************

738 Colorado Avenue Stuart, FL 34994

************************************************

Phone: 772-337-1040

************************************************

https://twitter.com/SFSTax/

https://linkedin.com/company/sfs-tax-problem-solutions

************************************************

Leave a Reply