As you may or may not know, my younger sister recently passed away and Ali and I just returned from the funeral in New York. Thank you to those of you that expressed your well wishes to us.

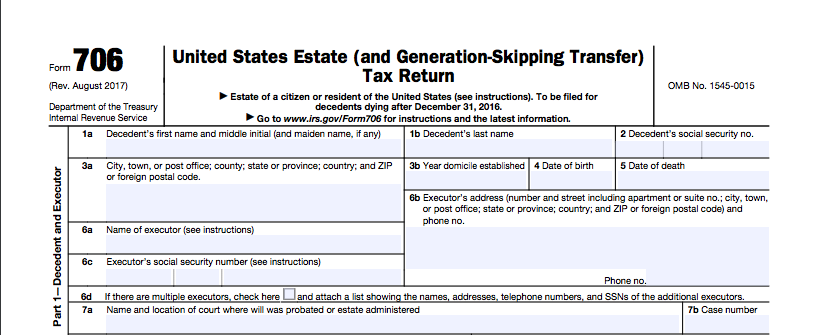

On that sad note, I want you to know that even when there is a death in the family, there may be tax filings, from final 1040s to estate tax returns and the estate’s income return.

I am an expert on the preparation of these tax returns in addition to the other more common ones such as federal individual, multi-state, gift, 990s etc as well as the following corporate returns.

- Form 1040 Schedule C, Profit or Loss From Business (Sole Proprietorship)

- Form 1040 Schedule F, Profit or Loss From Farming.

- Form 1065, U.S. Return of Partnership Income.

- Form 1120, U.S. Corporation Income Tax Return.

- Form 1120-S, U.S. Income Tax Return for an S Corporation.

It is important that you understand the portability rules between spouses and how we use these rules to offset any taxes the ultimate beneficiaries may face.

You seek out a financial planner for your estate financial planning, should you not consult a tax professional like an Enrolled Agent for your tax planning?

Tax planning is the analysis of a financial situation or plan from a tax perspective. The purpose of tax planning is to ensure tax efficiency. Tax efficiency is an attempt to minimize tax liability.

“An Enrolled Agent is America’s Tax Expert and the only authorized tax practitioner who has technical expertise in the field of taxation and who is empowered by the U.S. Department of the Treasury to represent taxpayers before all levels of the IRS.”

New clients mention this email and pay just $197 for the consultation. An appointment must be scheduled before March 22.

Call 772-337-1040 today or book your appointment online.

Learn more about Jeffrey Schneider, EA, CTRS, NTPIF

So until next time,

C Ya

Jeffrey “last of my family” Schneider

Leave a Reply