Jeffrey A. Schneider EA, CTRS, ACT-E, NTPIF | In the News

Jeffrey A. Schneider EA, CTRS, ACT-E, NTPIF, is the head honcho of SFS Tax & Accounting Services. He is an Enrolled Agent, (EA), a Certified Tax Resolution Specialist, (CTRS), Advance Crypto Tax Expert, (ACT-E) and an NTPI Fellow.

Jeffrey has been in the field of taxation for over 40 years beginning his career in the public sector and transitioned into private practice in 1999 when he founded SFS Tax & Accounting Services. He quickly discovered his passion for helping people that have tax problems and he handles both state and federal tax cases such as non-filers, penalty abatement, federal and state audits, etc.

He is a speaker for many professional organizations, shares his expertise at local expos and for various organizations on a wide variety of tax & business topics. Such as Taxation and the Cannabis Industry, What the Realtor Needs to Know About Liens and Levies, Ready to Take Social Security; How Will it Affect Your Tax Situation? and Tax and Financial Issue: Its Impact on Divorce, Taxation of Athletes, Entertainers & Artists and more. Jeffrey will customize his presentations for individual industries. Jeff also speaks on Tax Reform TCJA & §199A and Time Management.

He is often quoted in the press and has appeared on television as a tax expert and has hosted an internet TV show

In January of 2018, Jeff was appointed to the prestigious Internal Revenue Service Advisory Council (IRSAC) for a 3-year tenure. The IRSAC, established in 1953, is an organized public forum for IRS officials and representatives of the public to discuss various issues in tax administration. The council provides the IRS Commissioner with relevant feedback, observations, and recommendations.

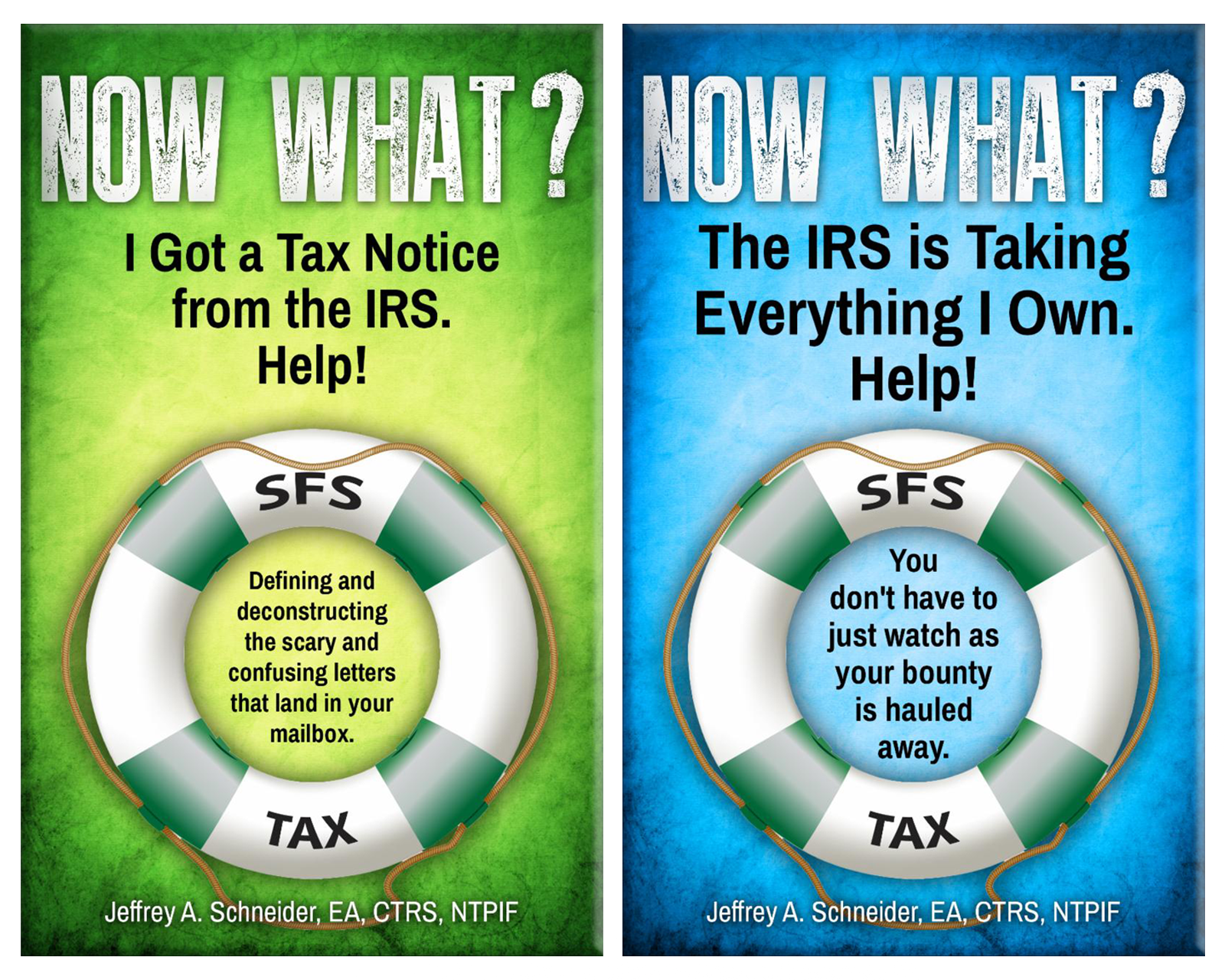

Schneider is the author of the Now What? Help! series – Now What? I Got a Notice from the IRS. Help! , Now What? The IRS is Taking Everything I Own. Help! and Now What? I Want To Prepare My Own Tax Return. Help!

All three books are available on Amazon in Ebook and paperback.

Upcoming Events

In the News

Tax Help Book ‘Now What? The IRS is Taking Everything I Own. Help!’ released today by SFS Tax Problem Solutions Press

STUART, Fla., Feb. 28, 2019 (SEND2PRESS NEWSWIRE) — SFS Tax Problem Solutions Press announces the release of the second book in the Now What, Help! series, “Now What? The IRS is Taking Everything I Own. Help!” by Jeffrey Schneider, an Enrolled Agent, Certified Tax Resolution Specialist, Advanced Crypto Tax Expert and a National Tax Practice Institute Fellow.

IRS Selects New Advisory Council Members

Jeffrey Schneider is an enrolled agent and a vice president with SFS Tax & Accounting Services in Port St. Lucie, Fla. His company handles all areas of tax for multiple types of taxpayers including bookkeeping, payroll and other related services. He is a fellow of the National Association of Enrolled Agents’ National Tax Practice Institute and a certified tax resolution specialist. Schneider earned his bachelor’s degree in finance from the College of Staten Island and his master’s degree in tax from Long Island University.

Media Quotes

Previous Speaking Engagements and Webinars

Webinar Presentations

Reasonable Compensation for S Corp Officers – October 1, 2018

Taxation of Athletes, Artists, and Entertainers – September 19, 2018 – 3:00-4:40

On-Demand Presentations

Taxation and the Cannabis Industry – August 28, 2018

Substantiating Business Expense Tax Write-offs – July 26, 2018

Reasonable Compensation for S Corp Officers – May 30th, 2018

Gambling and Taxes – July 12, 2017

Substantiating Tax Deductions – June 6, 2017

Protecting the Innocent Spouse From the IRS – June 27, 2016

Rental Real Estate Income – March 18, 2016

Representing Clients Who Have Stopped Filing Tax Returns – February 26, 2016

American Society of Tax Problem Solvers

American Society of Tax Problem Solvers

Tax Representation Super Conference

OIC/CNC Planning – Advanced Planning for Alternative Collections – October 19, 2018

![]() Non-filers – August 8, 2018

Non-filers – August 8, 2018 ![]()

Innocent Spouse – November 30, 2017

Non-filers – September 12, 2017

Gambling and Taxes – April 26, 2018

Florida Society of Enrolled Agents Chapter Affiliates Presentations

Palm Beach Chapter – Taxation and the Cannabis Industry – September 20, 2018

Suncoast Chapter – Taxation and the Gig Economy – September 27, 2018

Suncoast Chapter – Tax Reform TCJA & §199A – September 29, 2018 (6CPE)

Orlando Chapter – Gig Economy – November 20, 2018

Manasota – Taxation and the Cannabis Industry – December 12, 2018

National Association of Enrolled Agents State Affiliates

National Association of Enrolled Agents State Affiliates

2018 Presentations

Arkansas Society of Enrolled Agents (ARKSEA) – October 25- 26, 2018 – Section §199A, TCJA, Taxation, and the Cannabis Industry, Ethics, Expats

Texas Society of Enrolled Agents Convention (TXSEA)- July 6, 2018 – Taxation of Fringe Benefits, Reasonable Compensation of S Corp Shareholders

Louisiana Society of Enrolled Agents (LSEA) – June 3 – 5, 2018 – TCJA & Section 199, TCJA (4CE) Ethics (2CE)

Tennessee Society of Enrolled Agents (TNSEA) – June 21, 2018 – Tax Prep Track – Substantiating Deductions, Taxation of Athletes, Entertainers, and Artists (4CE) Representation Track – 433 & Case Study (4CE)

Washington Society of Enrolled Agents (WSSEA) – June 26-27, 2018 – Taxation of Fringe Benefits (2CE), Divorce and Taxes (2CE)

Georgia Society of Enrolled Agents (GAEA) – May 15 -16, 2018 – Taxation and the Cannabis Industry,- Overview of §280E Marijuana Returns (2CE), GigEconomy (2CE), Americans Working Abroad (2CE)

Texas Society of Enrolled Agents (TXSEA) Chapter Meeting – May 11, 2018 – OIC and case Study (4CE), Taxation of Athletes, Entertainers, and Artists