Hello Fellow Taxpayers,

This week, I was in DC attending the IRS Advisory Council meetings. My fellow members and I, work to help the IRS in their quest to have an effective tax administration (don’t laugh).

I want to bring up an issue that you may find interesting. Over the past few years, I have advised you that the IRS, in 99% of the cases, will not contact you by email and all letters via snail mail will look and feel official.

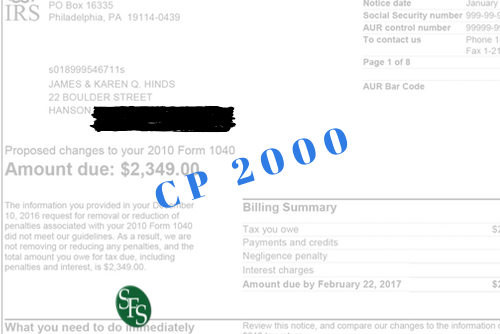

If you get a letter, it will be identified by some form of notice or letter number. Some may be CP 2000, LT 1058, CP 504, plus many more. If you are interested, my first book lists most of these notices and what they mean.

The purpose of this email is not to promote my book, but to advise you that if you get any notice, let me or your tax professional know. Do not just call or email to advise us that you received a notice. You need to send a copy (and you tend to get two) to me or your professional. If you are a client of SFS, you can use our secure portal to upload it. It is only then that I or your tax pro can help you.

By sending the notice, we can tell you if it is legitimate or a fake.

During this filing season, which lasts through October, the IRS, instituted a pilot program to notify clients that they believe that you did not report all of your income. Some of you may have received a CP 2000 notice that actually says the same thing. The difference is the CP 2000 instructs the taxpayer(s) to take action, and the notice imputes tax, penalties, and interest. It will also list your social security number.

The new “soft” notice, Notice 6115c is addressed to you but does not show your social security number(s). It does list the W2s or 1099s that the IRS believes was omitted.

Many of us in the tax professional community believes that this could be fraught with fraud. My point is, if you receive this notice, please contact me or your tax professional immediately. Although, the notice does not provide for a mandatory answer (unlike the CP 2000 which gives you 10 days to answer), do not answer it on your own. The letter will ask for you to send them a copy of your driver’s license, among other things if you believe the information they provided is not yours.

If you a member of the silver or gold level of my audit protection plan, there is no charge to look into this for you.

So until next time,

CYA,

Jeffrey “Knows all About IRS Notices” Schneider