Hello Fellow Taxpayers.

The tax season crunch is over, at least for now. Next week I am starting my travels to speak around the country. Although not as much as last year. Next week, I will be in DC attending the IRS Advisory Council spring meetings. This session, I am on the Wage and Income Subgroup which looks at things associated with form filling and security.

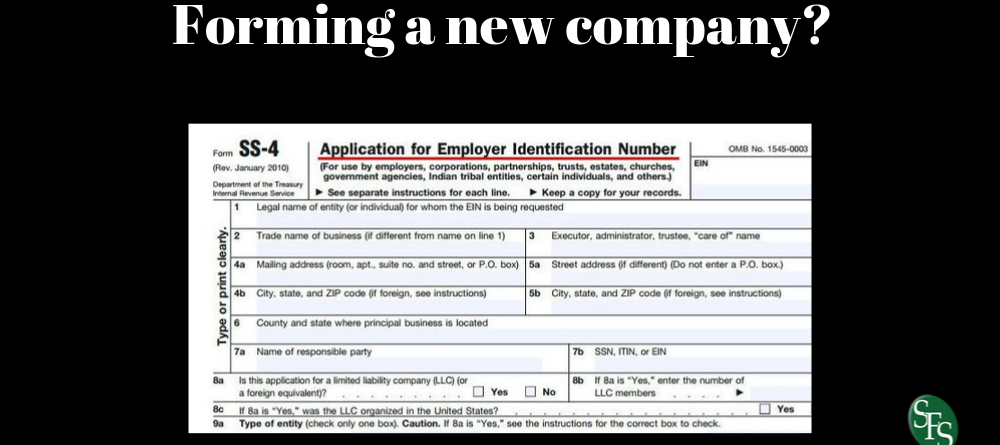

Speaking of which, the IRS has announced (News Release 2019-58) that it is making a change. This change has to do with who can complete an application for an EIN. If you or anyone you know is considering forming an LLC or incorporating, please share this email.

For non-professionals beginning May 13, 2019, only individuals can apply for an EIN as the “responsible party” on the application. ( Non-professionals are all others than an Enrolled Agent, CPA or Attorney.) This is part of the IRS’ ongoing security review and will provide greater security to the EIN process and improve transparency. This means, if an existing entity wants to own another entity, the individual who actually owns the first, must complete the application.

The individuals who are acting as responsible parties must have either a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN). Generally, this individual is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. In cases where more than one person meets this definition, the entity may decide which individual should be the responsible party. So as you can see, it cannot be a company as companies have Federal Employee Identification Numbers (FEIN).

This change basically prohibits an entity from using its own FEIN to obtain additional FEINs. This change applies to both paper applications on Form SS-4 as well as applications made through the IRS’ online EIN application.

The entity can later change the responsible party’s designation by completing Form 8822-B, Change of Address or Responsible Party.

This change does NOT affect tax professionals who are acting as third-party designees on behalf of their clients; meaning I can file these forms for the new owner. I would just need to secure a power of attorney. It is also a good idea to seek professional advice before creating the entity to make sure nothing is missed. Remember, in most cases, I cannot undo what has already been done.