Hello Fellow Taxpayers,

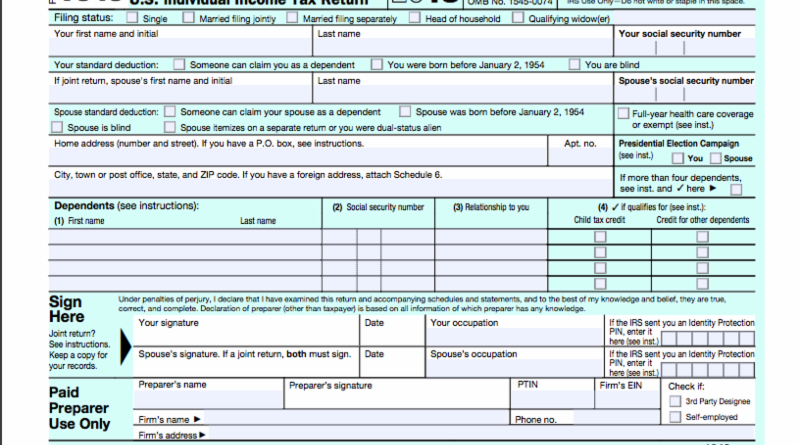

April 15th is only 18 days away and your tax return is due by midnight on the 15th.

Just for kicks here is a list of the 10 most popular reasons for filing late or not filing at all:

1. Laziness

2. Forgetfulness

3. Confusion

4. Death or Serious Illness of Taxpayer or Immediate Family

5. Invalid Advice From a “Competent” Professional

6. Active Duty Military Service

7. Incarceration

8. Ignorance

9. Destruction of Records

10. Belief That Paying Income Taxes is Voluntary

Are you using one of these reasons for having not filed yet? If so, you need to consider filing an extension.

Extension: Be aware that an extension doesn’t buy you more time to pay your tax bill. It simply gives you more time to file. When you request an extension, you must estimate your tax liability (if any) and send payment along with your request.

If you owe, do not delay filing the return or the extension as penalties can be 5% per month, plus interest, which is currently at 6% per annum. However, when you file the extension and the return and do not pay the correct amount with either, you will subject to late paying penalties and the interest. Late paying is ½% per month.

If you are getting a refund, why delay in getting your money back?

And if you cannot pay and maybe you owe for past years, we can help. There are collection alternatives. The IRS will not go away, no matter how much you. It may take a while (and we are talking months), but you will receive a notice. For more about notices check out my first book, Now What? I Got a Tax Notice From the IRS. Help! (see https://www.amazon.com/What-Notice-IRS-Help-Life-preserving-ebook/dp/B079XWL8P9).

However, one thing is for certain, they will come, smack a lien on you and then maybe a levy or wage garnishment.

So until next time,

C YA

Jeffrey “The Tax Extender” Schneider