In part one of this three-part series, we looked at changes to the income tax rates and brackets.

Income is only a piece of the tax puzzle, however. The next part to examine would be your deductions. With the Tax Cuts & Jobs Act, there are several new tax laws impacting your deductions.

New 20% Pass-Through Deduction

This is a brand new deduction on qualified business income (QBI) for pass-through businesses – sole proprietors, partnerships, limited liability corporations (LLCs) and S corporations.

This is an “above the line” deduction, meaning you can take it right off of your income, before figuring your tax due.

Generally, as a business owner, you will also need to have income of less than $157,500 if you are filing single and $315,000 or less if you are married filing jointly.

If you are above those income limits, there are several factors that can limit the deduction. For example, you’ll need to be a qualified trade or business.

What is a qualified trade or business?

It is all businesses not considered a “specified service trade or business.”

These are businesses that engage in the performance of services in the field of health, law, accounting/tax, actuarial services, performing arts, consulting, athletics, financial services, brokerage services or any other business where the principal asset is the reputation or skill of one or more employees or the owner of the business (other than engineers or architects).

If you are a high earner, you should consult with an experienced tax professional, like an Enrolled Agent (EA). An EA can help ensure you pay the least amount of taxes (legally) possible.

Changes to the Work Vehicle Depreciation Deduction

The amount of depreciation you can take for passenger automobiles used for business purposes has been increased.

Here’s the breakdown for 2017 versus 2018:

Passenger Automobiles (gross unloaded weight of 6,000 pounds or less, excluding trucks or vans)

- First year – $3,160 or $11,160 with bonus depreciation in 2017; increased to $10,000 in 2018 and $18,000 with bonus depreciation In 2018

- Second year – $5,100 in 2017; $16,000 in 2018

- Third year – $3,050 for 2017, is $9,600 in 2018

- Fourth year on – $1,875 in 2017, $5,760 in 2018

The bonus depreciation is available if you buy a new or used vehicle and put it to use within the tax year. The vehicle cannot be previously used by you or your business.

You need to use the vehicle 100% for business (based on mileage driven) in order to get the full deduction. You can still get a partial deduction based on the percentage of business use.

These amounts will also be indexed for inflation each year.

What if you have a pickup truck, a van, or a heavy SUV that’s over the 6,000 pound limit?

Since these vehicles are considered transportation equipment (versus a passenger vehicle), they have a more favorable tax treatment.

In fact, they are eligible for 100% bonus depreciation if purchased after September 22, 2012. This means that you can deduct the entire expense of the vehicle the first year you own it. The 100% will last until 2022, when it drops to 80% in 2023, 60% in 2024, 40% in 2025, and 20% in 2026. You still get regular depreciation when bonus depreciation is not 100%. There is also the IRC §179 election to expense.

Consult with an Enrolled Agent if you are in need of a new vehicle which will be used in your business and would like further clarification.

Elimination of Entertainment, Amusement or Recreation Expense Deduction

No longer will you be able to deduct expenses for entertainment, amusement and/or recreation (you could never deduct expenses for or a facility used for any of these purposes, like a golf club).

You will also no longer be able to deduct membership dues for business, pleasure or recreational clubs.

While that may sting, depending on your situation, you can still deduct 50% of food and beverage expenses you occur while operating your business, except when just “traveling around town.” Meals can be 100% deducted when traveling out of town (i.e., attending continuing education).

An Enrolled Agent can advise you further on which expenses are allowable… and which are not.

Raised Standard Deduction & Personal Elimination Exemption (and a Doubled Child Tax Credit)

If don’t itemize your taxes, you’ll be enjoying an increased standard deduction.

Single filers receive a $12,000 standard deduction in 2018, up from $6,350 in 2017. Married folks who file jointly will receive a $24,000 standard deduction, up from $12,700 in 2017.

But hold on… the personal exemption has been eliminated. (As an aside, we think that the 20% pass-through deduction talked about earlier will now be entered on this line).

Up until 2018, you could take a personal exemption in addition to the standard deduction. In fact, you could take it even if you chose to itemize your deductions.

How much was this personal exemption? $4,050 in 2017 per person, including spouses and dependent children. In some cases, the increase in the standard deduction will be wiped out by the elimination of the personal exemption.

However, the child tax credit was doubled to $2,000 per child, and 40% of it is now refundable (meaning you can get money back). You may also be able to take advantage of a $500 credit for “other qualifying dependents,” such as elderly parents. These credits are all subtracted from the tax you owe.

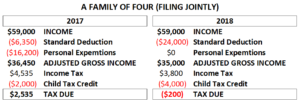

Here’s a quick example for a family of four, where the married couple is filing jointly:

Instead of paying $2,535, they will be getting $200 back… a $2,735 difference.

The best way to ensure you pay the least amount of tax legally possible is through a tax planning visit with an Enrolled Agent (EA).

************************************************

Jeffrey Schneider, EA, CTRS, NTPI Fellow has the knowledge and expertise to help you reach a favorable outcome with the IRS. He is the head honcho at SFS Tax & Accounting Services as well as an Enrolled Agent and a Certified Tax Resolution Specialist.

************************************************

Now What? I Got A Tax Notice From The IRS. Help! Defining and deconstructing the scary and confusing letters that land in your mailbox. Jeff defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what is what in the world of the IRS.

The book is available in paperback and ebook on https://Amazon.com

************************************************

For more on SFS Tax Problem Solutions, visit: http://sfstaxproblemsolutions.com/

For more on SFS Tax & Accounting Services, visit https://sfstaxacct.com/

************************************************

738A S Colorado Avenue Stuart, FL 34994

************************************************

Phone: 772-337-1040

************************************************

https://twitter.com/SFSTaxAcct/

https://linkedin.com/company/sfs-tax-problem-solutions

************************************************

Leave a Reply